George Seay is the founder and CEO of Annandale Capital, a global investment company that manages money for families, institutions, and high-net-worth individuals. Based in Dallas, Texas, he is a 7th generation Texan. As he told us on Episode 60 of the Agents of Innovation podcast, it’s hard to find roots that go back further than that in Texas.

George comes from an impressive family. On his maternal side, he is the grandson of former Texas Governor Bill Clements, a businessman who made who own way as a drilling contractor before he dived into the political realm. Clements was the Deputy Secretary of Defense under President Richard Nixon and reported directly to the President as he ran operations in the Pentagon. He later ran for Governor of Texas and served multiple terms. “He was the strongest, wisest, most formidable person I’ve been around in my life,” said Seay. When he was 19 years old, he worked on his grandfather Bill Clements’ last campaign for Governor.

On the paternal side, his other grandfather, another George Seay, was a prosecutor at the Nuremberg Trials, where he was on a team of seven prosecutors who convicted Nazi war criminals following World War II.

These two men gave the younger George Seay a solid foundation to build upon and he is certainly doing just that.

George played football in high school and was sought out by many college teams, including Harvard, where he turned down an opportunity to play. He was also accepted at elite institutions like Stanford and Princeton. However, he chose to remain in Texas and attend school at the University of Texas in Austin, where he graduated from. “I’m a Texan. I love being in Texas,” said Seay. He also believes you should “go to a school you’re going to be joyful and content and happy at it. Don’t go to a school where it’s based on one arbitrary rank ahead of another school.”

George Seay had a windy path before he figured out what he wanted to do for his career. After college, he went to law school at Southern Methodist University in his hometown of Dallas; and then when he figured out being a lawyer wasn’t for him, he returned to UT-Austin for an MBA. “Anybody who thinks they are going to chart their path in life and know exactly where they are going, they are going to get humbled at some point,” says Seay.

In 1998, he started Annandale Capital with $50,000 and $17 million in commitments. “Thank God I was break even from day one,” he recalls. “I thought: I’m 31 years old, what a great guy I am, everybody’s going to hire me from day one. It was delusional, arrogant, and stupid. Sometimes it’s nice to be young and dumb when you’re starting a business because you don’t realize how difficult it’s going to be.”

When Annandale Capital started, it was mostly just investments in U.S. stocks and bonds. As the company evolved, they expanded into global stocks and global bonds, private equity, hedge fund, venture capital, real estate, oil and gas minerals, and cash management.

While they take on a wide variety of clients, they all have a common bond: “Our goal is to serve people that we really admire and respect ad are high integrity people.”

“At Annandale, we’re fiduciaries. We have a moral, legal, ethical obligation to put our clients’ interests ahead of our own,” said Seay. The market in 2008 was a really rough time for the company and there were some days George says he was wondering “how am I going to keep the lights on … and keep all these people employed.”

“Entrepreneurship is really grueling and hard work and you have to be focused, committed, determined and you have to persevere when things aren’t working,” he says. “I nearly quit twice building my company because it was so hard and because things looked so grim. The business I’m in is really volatile and mercurial and it takes a lot of stamina and I just could not be more thrilled today that I pressed on and persevered because I would have given up on something that’s now a $3 billion under advisory global investment company and I run into work every morning I love what I do so much. And I never had any idea this is what I’d be doing.”

Today, Geoge Seay’s financial commentary is sought by FOX Business and MSNBC, places where he appears as a regular contributor. He has also been brought on as a guest of Larry King and is quite often quoted in an array of print media.

But it’s not all stocks and bonds for George Seay. He is also invested in many philanthropic efforts, where he applies many of the same principles. “People don’t have to be just entrepreneurs in their business life,” he says. “I’ve applied that same kind of too young and dumb to quit mentality to nonprofit work.”

He is the co-founder of Legacy, which he describes as “a fellowship of 200 families all around the country that were mainly civic, business, and philanthropic leaders very strategically getting involved in politics in short spreads of time and then returning to their homes.”

Following his grandfather Bill Clements death in 2011, George was approached by a professor at the University of Texas-Austin to name a new Center for National Security at UT-Austin after his grandfather. Today, the Clements Center for National Security is an on-campus “do-tank,” encouraging young people to get their undergraduate and graduate education in place and go serve their country in national security positions or teach the subject at various universities. Seay feels proud of the work they are doing there. “It’s 6 years in and now an internationally-acclaimed institution,” he says.

Seay’s business expertise is also leveraged in his role on the Texas-Israel Chamber of Commerce, now the Texas-Israel Alliance, where he has served as Chairman for the past two and a half years.

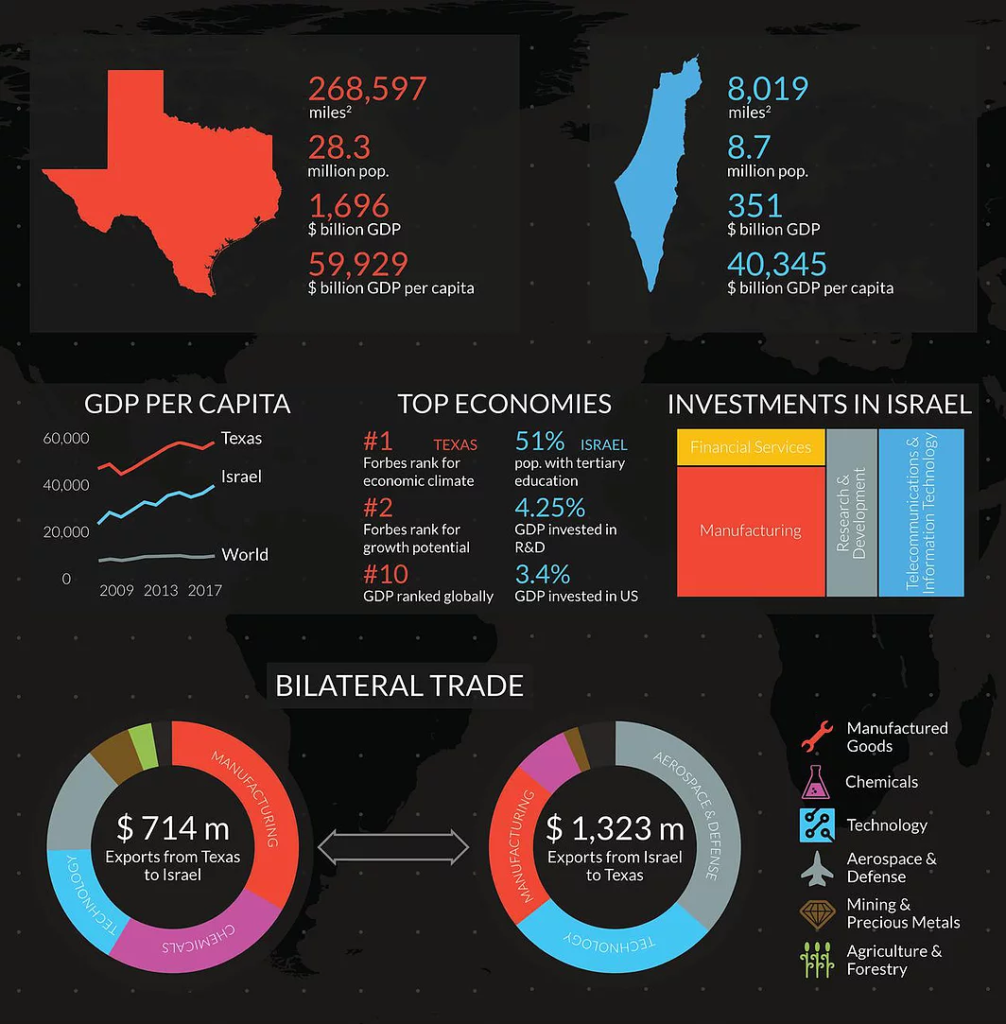

George recalled his first trip to Israel in 1985 with his family when he was fresh out of high school. At that time, GDP per capita in Israel was $7,000 per person. On his second trip to Israel in 2009, GDP per capita was $20,000 per person. When he went on a recent trade mission to Israel in 2019, GDP per capita in Israel had spiked to $42,000 per person.

“Israel’s economic advancement really is miraculous,” said Seay. “It’s a real testimony to the Israeli people.”

As he reflected on this economic miracle, Seay recalled how “Israel started drifting away from socialism in the last twenty years and fully embraced capitalism.” When they did that, Israel saw expansions in the life sciences industry, agriculture industry, technology industry, and the energy industry.

“They have created so much value and it has just exploded,” notes Seay. “The quality of life for all Israelis has gone through the roof. They are a glaring illustration of how capitalism – with all its flaws – is a far superior system in creating high quality of life for all its citizens than socialism is.”

Many states now have trading partnerships with Israel, including Texas, which by itself is the 10th largest economy in the world. There is currently $1 billion in economic activity between Texas and Israel (with only New York and California as U.S. states who do more business with Israel). Religious ties, military and strategic interests, and commerce are some of the reasons why so many in the United States (including Texas) are interested in having Israel as a trade partner.

“This really wouldn’t function well for Texas if all we were doing was benefitting Israel,” said Seay. He says his “mandate as a patriotic Texan – who views Israel as a critical ally” is that “Texans have to benefit exactly as Israelis do – 50/50 – or this isn’t worth doing. So, we are laser-focused on Texas companies investing in Israel but Israel companies investing in Texas and bringing jobs to Texas as well.”

Texas companies from a diverse area of industries are investing in Israel. They include AT&T, Dell, Intel, Checkpoint Software and many others. Texas companies also have a major energy footprint in Israel. Noble Energy, a firm out of Houston, is the Texas company that found the Leviathan gas field that gave Israel energy independence. Israel now has a huge pool of natural gas offshore.

While George Seay has made a living and a life through his own Texas company, Annandale Capital, he has used his expertise and his heart towards helping this people of his community, of his state, and of our nation through his endeavors of service. “It’s really fun to be an entrepreneur in the philanthropic area,” he says.

And applying a philanthropic attitude towards one’s business is also important. Being an entrepreneur isn’t easy and there were certainly many times he could have given up. But the legacy of his own family surely taught him better. “When you believe in what you’re doing, and it’s worthwhile, and you’re serving other people, persevere. Keep going, keep after it.”

We sure are glad George Seay kept after it – he is building upon a Texas legacy that would make any Longhorn proud. You can listen to our full interview with George Seay on Episode 60 of the Agents of Innovation podcast which can be heard on Apple podcasts, Stitcher, or SoundCloud. You can also follow the podcast on Facebook, Instagram, or Twitter. We welcome your comments below and encourage you to write a review on Apple podcasts!